Two St Albans residents — along with another Melbourne man — have been convicted of dishonesty offences for their role in promoting ‘interest-free mortgages’ offered by the company Remedy Housing between 2019 and 2021.

The convictions come after a jury found the three Remedy Housing officials guilty after a four-week trial in the County Court of Victoria.

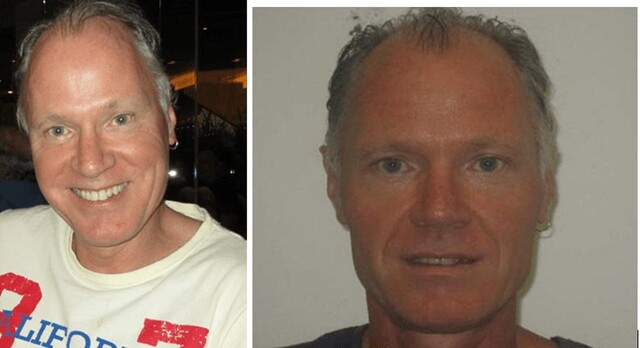

Brent Lindsay Smith and Fue Heidi Mano — both from St Albans — and Mahmoud Khodr dishonestly represented that Remedy Housing would provide consumers with an ‘interest-free mortgage’ and title to a home within 12 months, upon payment of a deposit of at least $10,000.

They also dishonestly represented that if Remedy Housing could not provide an ‘interest-free mortgage to the consumer within that period then the deposit would be refunded in full.

In addition, Smith, Mano and Khodr misled consumers into believing the company was financed by overseas investors, including financing from former Samoan international rugby union player Trevor Leota.

Leota was not charged in relation to this offending.

Remedy Housing was operated by Smith and Khodr as director and secretary respectively.

Mano was an officer of the company who was involved, together with Leota, in promoting the business to consumers, primarily in the Pacific Islander communities in Australia and New Zealand.

Remedy Housing had no investors or funders, never provided any mortgages, and the funds it acquired from customers’ deposits were used to operate and promote the scheme and transferred to the personal accounts of Smith and Khodr.

The matter was prosecuted by the Office of the Director of Public Prosecutions following an investigation and referral by the Australian Securities and Investments Commission (ASIC).

ASIC chair Joe Longo, said “the jury’s decision in this case demonstrates the community’s concern with deception of this scale.”

“This prosecution demonstrates ASIC’s commitment to ensuring dishonesty in the credit and financial services industry is penalised,” he said.

A sentencing hearing has been scheduled for the trio in September this year.

They each face a maximum penalty of up to 15 years’ imprisonment and/or a fine of up to $765,000.